Payroll Automation

With just a few clicks, calculate salaries for all employees by considering all payroll supplements based on the actual schedule and recorded attendance!

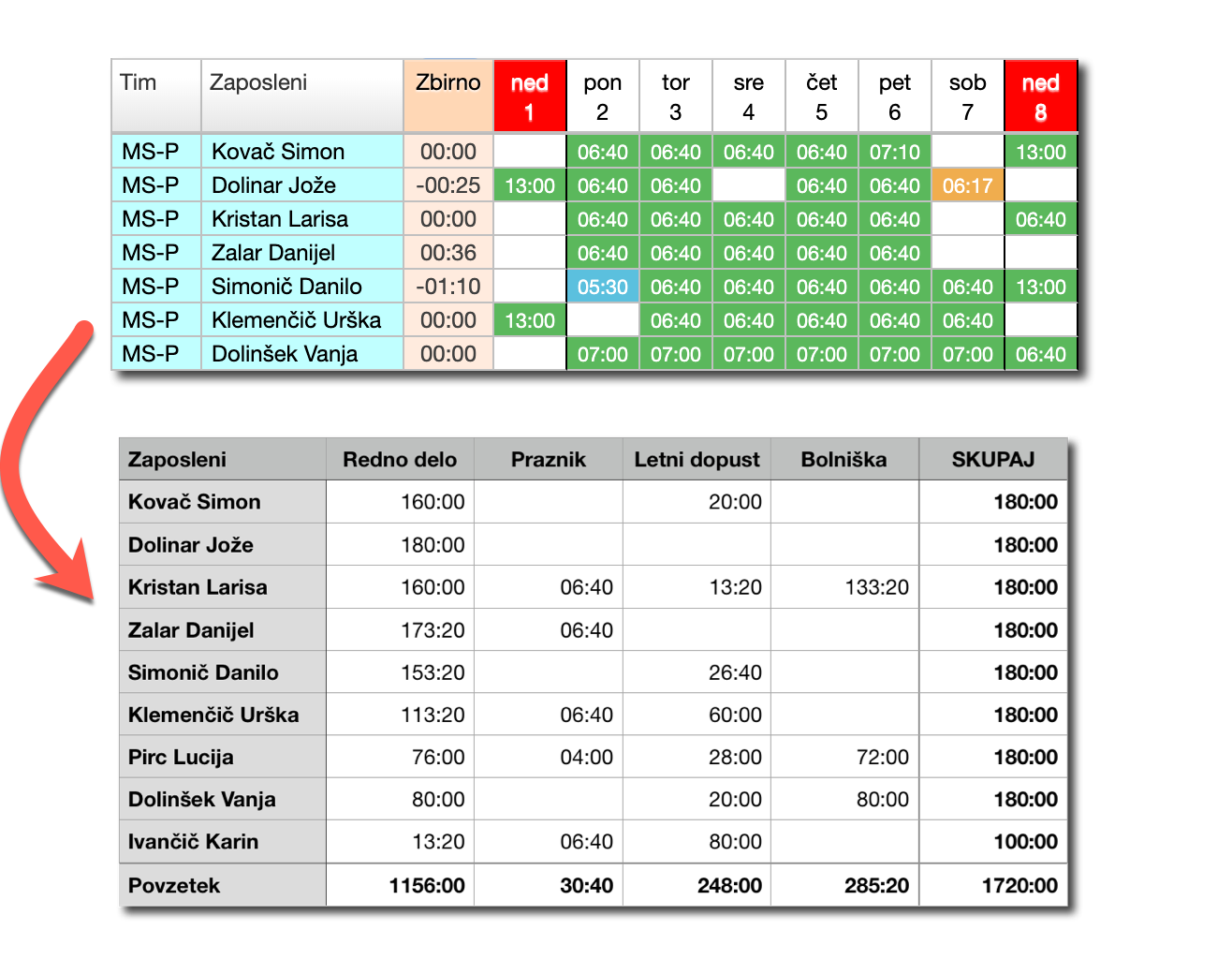

Calculation of Hourly Rates

Based on the entered schedule and recorded registrations, the application calculates hourly rates for the monthly payroll in just moments. The types and methods of calculating hourly rates can be detailed and customized according to the needs of the customer.

Types of hourly rates include:

- regular work,

- overtime,

- holidays,

- leave (annual, emergency, study, maternity),

- training,

- sick leave.

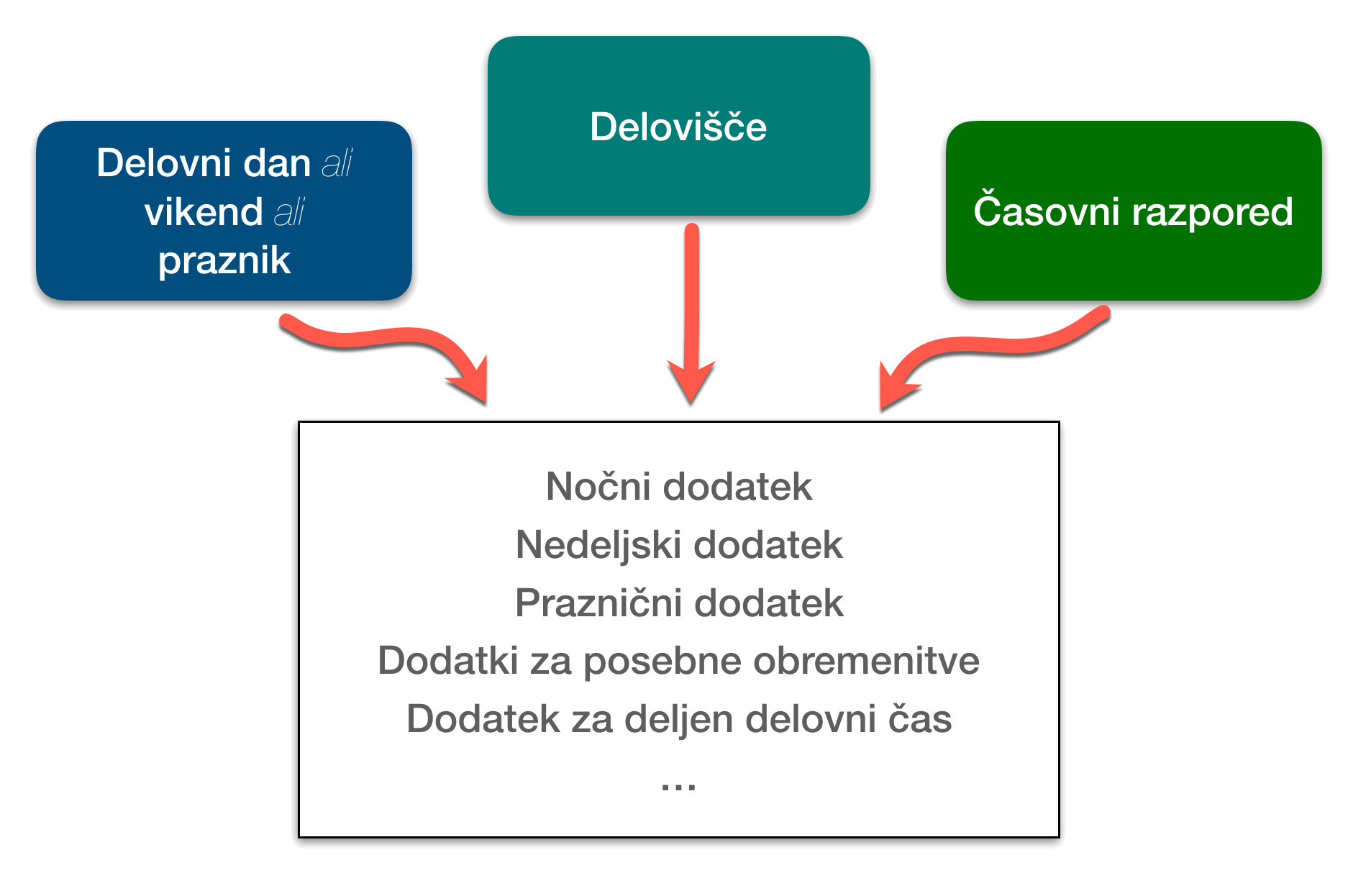

Calculation of Payroll Supplements

Manually calculating payroll supplements is a very time-consuming task and can result in many errors. Payroll supplements are often dependent on multiple factors: work schedule, workplace, type of day (holiday, weekend, etc.), some of which may also be mutually exclusive. With the ShiftPlan application, you can calculate all supplements without errors in just moments.

The application enables the calculation of all types of payroll supplements specified in various industry collective agreements and labor legislation, including:

- Sunday supplement,

- night shift supplement,

- holiday supplement,

- hazard and special burden supplement,

- irregularly distributed working hours supplement,

- split shift supplement,

- meal allowances,

- transportation to work.

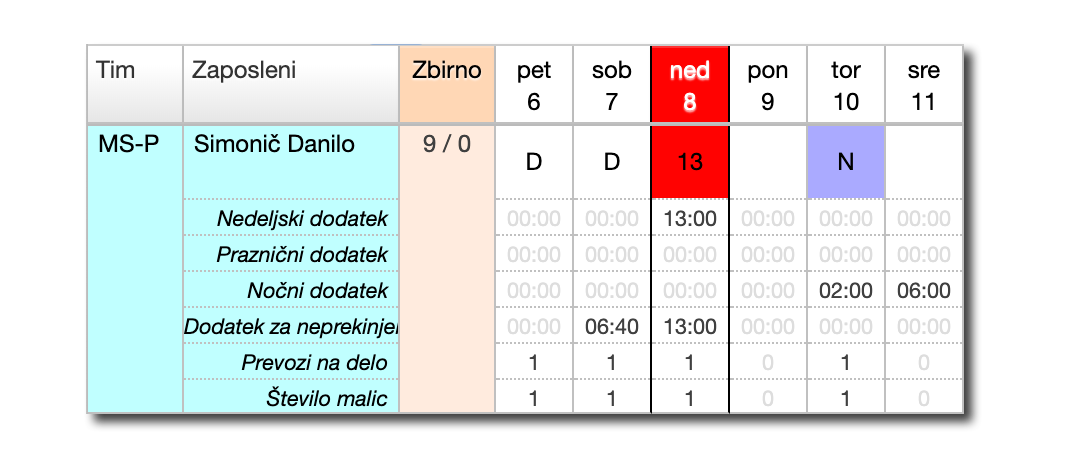

Review and Verification of Salary Supplements

All payroll supplements can be displayed in the schedule table by individual days and employees. This way, you can easily check why a specific employee has been allocated a certain amount of a particular supplement for a given month.

If you find that a manual adjustment of a supplement is needed due to special circumstances (e.g., additional transportation), you can easily modify it directly within the schedule editor.

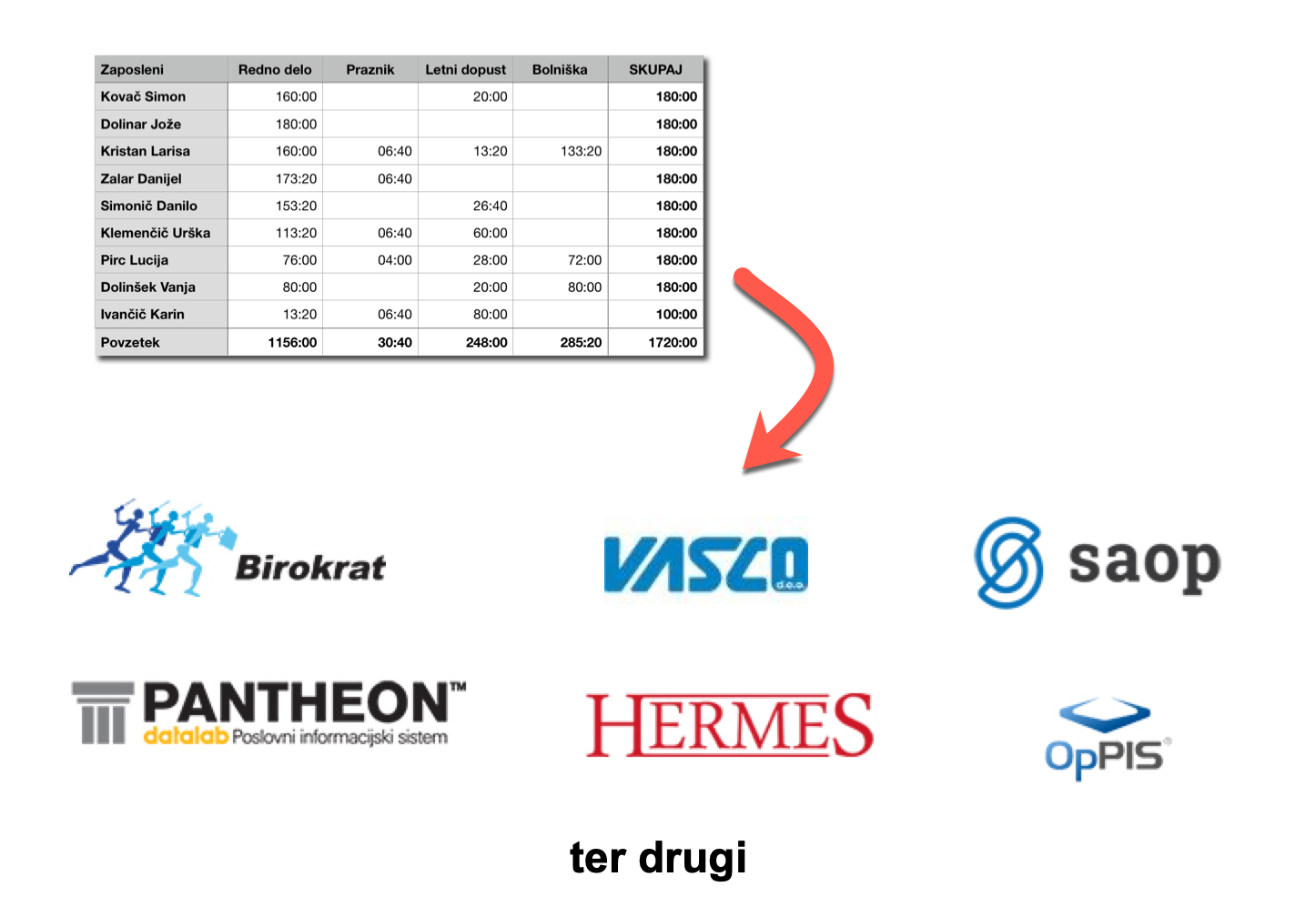

Export to Accounting Programs

Easily export the calculated hours and supplements to an accounting program for payroll processing. Access to the payroll sheet can also be provided to employees through the employee portal.

We support export to all accounting programs widely used in our market, and we can also prepare custom exports as needed.